Before jumping to the conclusion you must know that Denmark’s tax structure is progressive, with relatively high rates compared to many other countries. Denmark has a progressive tax system, which means that higher-income individuals pay higher taxes than lower-income individuals. Tax rates rise with income level. Income tax is the principal type of taxes in Denmark. Individual income tax rates can range from approximately 8% to 55.9% for the highest income group as of 2022. However, it is important to note that numerous deductions, credits, and allowances can have an impact on an individual’s effective tax rate. Denmark have top brackets and bottom brackets for Tax according to your earning. So amount you pay may vary measuring your income level. You may either pay 12.09% or 15%. However, the fact that you must pay labour and municipal tax doesn’t changes. Lets break it down.

“Top-bracket tax is levied on the part of your income that exceeds a basic allowance (lower limit) of DKK 588,900 (DKK 640,108 before labour market contribution) i 2024.” Says SKAT.dk

Hereafter, if you come on category of paying top-bracket ,exceeding the basic allowance limit, you’ll be paying 15% on your excessive income.

Or

If you are under or meets the requirement of basic allowance you’ll only be paying 12.09%. Note: Here I’m talking about top and bottom tax excluding other tax which you pay in total while getting your salary.

Let’s Understand the income tax as whole :

In total you’ll be paying Municipal Tax (Local Tax) + Labour Tax + Bottom/Top Tax. For instance, average of municipal tax 25.018 % (according to PWC) + Labour 8% + Bottom/Top 12.09/15% . However, after the deductions of other factors like ATP. You’ll only be paying Labour Tax 8% for your personal allowance ( I guess you’re calling it a frikort or skattefradrag). Then after, they deduct your personal allowance and levied rest of tax on remaining income. Don’t forget the holiday pay 😀 which is 12.5% of your total income before tax.

You want to get surface of how much amount you’ll get after tax in your bank. Here, use this calculator as reference only. —Remember this is just reference and give approximate value as result—

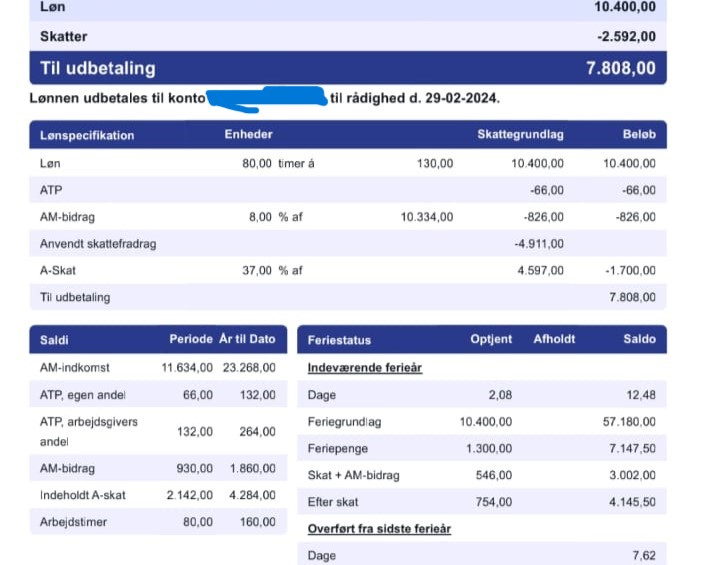

Yet again, Lets see the real payslip and analyse the TAX.

As you can see in above image, a payslip of Student who works 80 hrs in a Month and his salary was 130 per time. Notice how the tax is being calculated, first they deduct ATP, which is a is a Danish supplementary pension and the country’s largest lifelong pension scheme. And thereafter, 8% labour which is also known as AM-bidrag and then they deduct frikort/skattefradrag and levies tax on rest of your income i.e. 37% in above case. Remember , it may vary upon municipality and also your income. And finally, after adding the frikort to your income after tax deduction, you get to look at your final salary.( The income tax currently varies between a total of 37 percent (for taxpayers who pay bottom-bracket tax and who do not pay church tax) and a total of 53 percent (for taxpayers who pay top-bracket tax and who also pay church tax). Your personal income tax rate is stated in your tax card. ) mentioned in http://kk.dk.

This articles collects some facts from the Danish website which link is mentioned in the article. Please refer to Skat.dk for more information .

Read More : http://bibeshnepal.com.np/what-denmark-statistics-shows-about-nepali/

Great Information.